Industrial Automation’s Connection to the Growth of Advanced Manufacturing in México

Mexico's industrial landscape is undergoing a significant transformation, driven by a surge in industrial automation and advanced manufacturing. Fueled by a powerful nearshoring wave and record levels of foreign direct investment (FDI), the country's manufacturing sector is expanding and moving up the value chain.

In 2023, manufacturing captured half of the nation's record $36 billion in FDI, funding growth in high-tech sectors like automotive, aerospace, and electronics. This industrial boom is built on a foundation of skilled labor, with Mexico producing over 120,000 new engineers and technical professionals annually. Complemented by strategic government policies aimed at workforce development and attracting investment, these factors have solidified Mexico's role as a critical link in North America's manufacturing supply chain.

While recent months have revealed significant near-term challenges in the form of tariffs and cooler U.S.-Mexican governmental relations, the deeply interconnected supply chains and existing relationships will continue to drive trade and economic cooperation between the United States and Mexico. This report will examine the factors North American businesses should consider when evaluating Mexico as a strategic opportunity in the context of industrial automation.

Employment Trends

Mexico’s manufacturing sector is a major employer and has shown resilient growth in the past five years, especially as the economy rebounded from the 2020 pandemic downturn. According to the National Occupation and Employment Survey (ENOE), about 9.7 million people worked in the manufacturing industry as of late 2024, representing roughly 16.3% of total employment. This marks an increase of 465,000 manufacturing jobs compared to a year earlier, reflecting strong post-pandemic recovery and new investment. For comparison, in October 2023 the sector employed around 9.2 million (about 15.6% of employment), so the recent nearshoring wave has pushed manufacturing employment above even pre-pandemic levels. Manufacturing remains the third largest source of jobs in Mexico after services and commerce.

However, growth has varied year to year. During 2020, manufacturing employment dipped from roughly 9+ million before the pandemic to around the mid-8 million range, based on INEGI data, but it rebounded by 2021-2022. By 2022, manufacturing jobs had recovered to roughly 9.3 million, and though 2023 saw a slight contraction (0.5% decline), the sector bounced back in 2024 with robust gains. Notably, despite some fluctuations, the Monthly Manufacturing Survey indicated employment declines in many months of 2023–2024, the overall trend has been upward thanks to new factories and expansions coming online.

Within advanced manufacturing, certain industries are key employers. Automotive manufacturing is especially large; Mexico is one of the world’s top vehicle producers and exporters, and this sub-sector alone accounts for a significant portion of manufacturing jobs. Other advanced industries like aerospace, electronics, medical devices, and machinery have also expanded their workforce in recent years, particularly in central and northern Mexico’s industrial hubs. For instance, the state of Nuevo León led the nation in manufacturing employment growth recently, even as national manufacturing jobs briefly dipped. Mexico’s industrial labor market has shown resilience and modest growth over the last five years, with advanced manufacturing providing high-skill employment for roughly one in six Mexican workers.

Skilled Labor and Workforce Development

Mexico has been steadily building a pool of skilled labor in fields relevant to automation and advanced manufacturing. Each year, hundreds of thousands of students graduate in engineering and technical disciplines, feeding the talent pipeline. In the 2021 academic year, about 474,000 students graduated from higher education programs in Mexico. About 26% of these graduates specialized in engineering, manufacturing, and construction fields, representing roughly 124,000 new engineers and related professionals. This share of engineering graduates is the largest among all fields of study, reflecting Mexico’s emphasis on technical education. By comparison, the next largest fields were business and administration at ~23% and health sciences at ~14%. Such output places Mexico among the top countries globally in engineering talent, as it ranked around eighth in the world for number of annual engineering graduates as of 2022, with over 115,000 per year.

This strong education pipeline is backed by government initiatives. The Mexican government has expanded training opportunities in technical fields. In 2022, over 300 higher education programs were updated to align with Industry 4.0 skills needs, while 129 new undergraduate and technical programs were created, including specializations in robotics, automation, semiconductors, and AI.

As a result of these efforts, Mexico’s skilled labor availability in automation-related fields is robust. The Mexican Labor Observatory reports that as of early 2024, there were over 2.7 million professionals employed in engineering and related occupations nationwide. This includes more than 800,000 in computer science and IT, 500,000+ in mechanical, electronic, and technological engineering, and hundreds of thousands in industrial, electrical, chemical, and other engineering specialties.

This human capital is a key asset: a large, young workforce with STEM skills has been pivotal in attracting high-tech manufacturing projects to Mexico. The median age in Mexico is only 29, and the government notes it has 859,000 technicians and STEM specialists entering the labor force in recent years who are “ready to leverage innovation and technology transfer.” Overall, Mexico’s focus on workforce development through expanded university programs, scholarships in critical fields (e.g., new CONACYT scholarships for semiconductor and robotics studies), and industry partnerships, is focused on growing a supply of skilled labor for automation and advanced manufacturing needs.

Foreign Investment Trends in Automation and Manufacturing

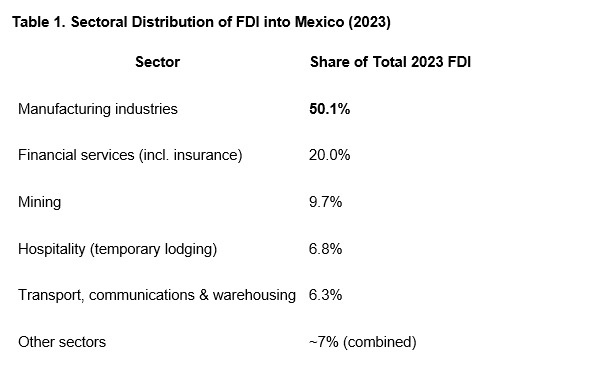

Data from 2023 and 2024 showed foreign direct investment (FDI) into Mexico’s advanced manufacturing sectors has surged, reaching record levels, although the post-tariff 2025 period may have pared back these inflows.

In 2023, Mexico received $36 billion USD in FDI, the highest annual amount on record. This was a 2.2% increase over 2022. Manufacturing is by far the leading destination: about 50% of all FDI in 2023 went into the manufacturing sector. By contrast, the financial sector accounted for 20%, and all other sectors combined made up the remaining 30%. This underscores how foreign investors are channeling capital into Mexico’s factories, with recipients ranging from automotive plants and electronics assembly to machinery, metals, and chemicals.

Within manufacturing, advanced industries dominate the inflows. The Secretariat of Economy reports that in 2023, the largest manufacturing FDI went into transportation equipment (automotive and aerospace), which comprised about 41% of manufacturing FDI. Other key manufacturing recipients included beverage and food processing (14%), metal products (13%), computer and electronic equipment (9%), chemical industries (8%), and equipment for power generation (5%).

This focus toward high-tech industries aligns with Mexico’s new industrial policy. Many multinational companies have expanded existing plants or established new facilities in these sectors. For example, in the electronics and automation domain, companies from Asia and the United States have increased investment in Mexican factories producing components and devices.

Geographically, FDI has focused on Mexico’s industrial core. Over half of 2023’s FDI was concentrated in just a few states: Mexico City (31% of total), Sonora (7.5%), Nuevo León (7.0%), Jalisco (5.6%), and Chihuahua (5.5%). Notably, northern states have been big winners. These are regions known for advanced manufacturing clusters, including automotive in Nuevo León and Chihuahua, aerospace in Sonora, and electronics in Jalisco. The United States remains the top source of investment, representing about 38% of FDI in 2023, with significant contributions from partners like Spain and Canada as well. Mexico’s appeal has grown under the USMCA trade pact, making it a prime destination for companies looking to nearshore production closer to the U.S. market, but again, things may look different from 2025 onwards as the tariff situation continues to develop.

Looking at trends from 2024, foreign investment in manufacturing not only grew in volume but also in scope of projects. Advanced manufacturing in Mexico now spans EV factories, semiconductor packaging plants, battery gigafactories, and more. Mexico is positioning itself in North America’s high-tech supply chains: for instance, the country’s economy ministry highlighted that Mexico became the United States’ top trading partner in 2023, thanks in part to booming exports of vehicles, electronics, and machinery. This integration is fueled by sustained FDI in those sectors. The forecasts from 2024 were positive, with economists projecting FDI inflows could reach $40 billion in 2024 and $42 billion in 2025, given the strong nearshoring momentum. As numbers come out from 2025, it’ll be interesting to see what impact the trade uncertainty and tariffs have on these capital flows.

Nearshoring Boom and Job Creation

Analysts estimate that around 15% of all new formal jobs in Mexico have been generated by nearshoring activity in the past year. In other words, one out of every seven new formal jobs is tied to companies either expanding or setting up operations in Mexico to serve U.S. and global markets. This trend is especially pronounced in the north and central regions of Mexico, which are attracting manufacturing firms in automotive, electronics, and other tech industries. The result has been higher employment and lower informality in those regions, with northern states now reporting some of the highest employment rates and lowest informal sector rates in the country.

Government Policies and Incentives for Automation and High-Tech Manufacturing

Mexican authorities have implemented several policies and incentives to foster industrial automation, advanced manufacturing, and nearshoring. A cornerstone is the country’s new National Industrial Policy, unveiled in 2022, which identifies strategic sectors for targeted support, including areas such as EVs, semiconductors, medical devices, and aerospace. This policy emphasizes integration into high-value supply chains and the adoption of Industry 4.0 technologies. Concretely, the government has introduced fiscal incentives, training programs, and regulatory support to attract investment in these areas:

- “Plan México” Nearshoring Incentives (2024) – In early 2025, the Mexican government announced ~$1.5 billion USD in tax incentives over the next six years to support companies that invest in Mexico as part of supply chain relocation. This policy was established by a presidential decree and is part of the Plan México strategy to position Mexico as a top-10 global economy by 2030. The incentives include tax breaks and credits for companies in strategic industries such as EV manufacturing, semiconductor assembly, pharmaceuticals, and others deemed crucial and support for those that implement training programs or establish projects in Mexico. Essentially, firms can receive financial benefits if they both invest in productive capacity and help train local talent through apprenticeships or university partnerships.

- IMMEX and Targeted Sector Programs – Mexico continues to operate long-standing programs that encourage manufacturing for export. The IMMEX program (Manufacturing, Maquiladora and Export Services Program) allows manufacturers to import inputs and equipment duty-free as long as the finished goods are exported. This effectively lowers the cost of upgrading to new machinery or automation equipment for export-oriented factories. In addition, specific sectors have tailored programs. These policies have underpinned growth in highly automated industries. Example: The automotive sector in Mexico, with its large share of robotics, benefitted from such incentives while helping Mexico become one of the world’s largest car exporters.

- Workforce and Innovation Initiatives – The government’s Talento Mexicano initiative is a policy effort to bridge education and industry. Through this program, authorities have expanded vocational training in automation technologies. One example is the creation of new technical specializations. In 2024 Mexico’s technical universities introduced courses in industrial robotics, Industry 4.0, and semiconductor design across various campuses. Moreover, the Science and Technology Council increased funding for R&D projects in advanced manufacturing, such as grants for developing Mexican-made robotics and automation software. The federal government has also partnered with the United States under the High-Level Economic Dialogue to train workers for the semiconductor sector, given the planned investments in North American chip fabs. By mid-2024, over 5,900 Mexican engineering students had undergone specialized training in semiconductors, some in partnership with ASU, to prepare for jobs in that industry.

- State-Level Incentives – Various state governments offer their own perks for high-tech manufacturing. For instance, Nuevo León offers payroll tax reductions for companies in automation or IT sectors setting up in the state. Jalisco, often called Mexico’s Silicon Valley, has innovation parks and provides grants to firms that establish R&D centers. This helped attract firms like Intel and HP in the past. Chihuahua and Baja California have special economic zones focused on aerospace and electronics, with local tax abatements.

Overall, Mexico’s public policy is increasingly set up to support industrial automation and high-tech manufacturing growth. By combining fiscal incentives, talent development, and trade advantages, the government is pushing for Mexico to pivot into a hub for advanced manufacturing. As evidence of success, Mexico’s economy ministry reported that by the end of 2023 Mexico had risen to ninth globally in FDI inflows and is now fourth worldwide in heavy vehicle exports and sixth in light vehicle exports.

With continued policy support, the trend of nearshoring-led industrial automation is expected to persist, creating more high-skill jobs and deeper integration of Mexico in global high-tech supply chains. Although, again, these efforts could face significant headwinds from the current turbulent and uncertain trade environment with the United States, with auto-sector tariffs representing the single largest threat.

Conclusion

Mexico has experienced significant growth in industrial automation and advanced manufacturing in recent years, thanks to factors including positive employment trends, a large and growing skilled workforce, increasing foreign investment, and accommodating government policies.

Employment in manufacturing now stands near record highs, approaching 10 million jobs, and an increasing share of these jobs are in high-tech sectors or require advanced skills. The country produces over 120,000 new engineers annually, contributing to the workforce in emerging industries like EV production and electronics. Foreign investors increased capital investments into Mexican factories with manufacturing received half of all FDI in 2023. This influx, especially via nearshoring trends in 2023 and 2024, has led to the establishment of new production facilities and tens of thousands of new jobs in sectors such as automotive and semiconductors.

Government policies have both responded to and reinforced these trends. Through fiscal incentives, training initiatives, and industrial promotion, authorities are encouraging automation and investments in advanced manufacturing.

Going forward, the continuation of these trends will be critical for Mexico to climb the value chain. The biggest area of uncertainty is extrapolating these very positive trends from 2020 to 2024 into the new 2025 reality. The trade environment is changing by the day, and it’s too soon to get a solid picture on what FDI and trade between the United States and Mexico will look like under the Trump administration’s trade paradigm. With Mexico’s export economy being so closely connected to the United States, continued pressure via tariffs or other trade-impacting measures will weigh down this sector, and more broadly the Mexican economy, albeit to a lesser extent.

Leave a Reply